An offshore oil rig owned by the Tullow Corporation, one of the chief oil prospecting companies operating off of Ghana's coast. Image sourced from here.

One of the most fiery issues during last summer's political campaigns was oil and how the new government would distribute the revenues. With news coming in almost weekly about how the volume of likely untapped reserves is increasing, the government has committed itself to continually reaffirming that it will manage the revenues wisely, as in this story posted on the government website yesterday. One key excerpt:

Dr Donkor said, government's policy direction for the oil and gas sector is informed by fundamental issues such as resource ownership and jurisdiction, fundamentals of fiscal and legal framework, broad relationship among actors in the petroleum sector, broad institutional framework, local content and indigenisation and principle of state and national participation.Those are all great catch-phrases, but it remains to be seen how it will be put into action. Just talking with Ghanaians, it seems that most are up with the issues, stating that, "We don't want to become like Nigeria." Seems to be prevailing sentiment around Africa.

But oil is tricky for most governments (check this out). One key economic concern for Ghana is the decline of agriculture, particularly in the already ethnically volatile northern regions.

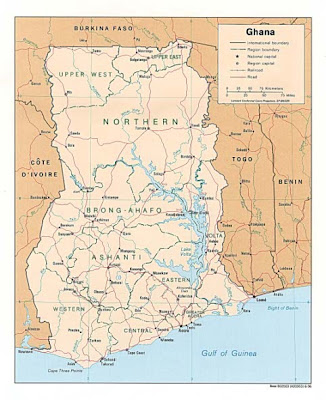

Map of Ghana. Upper East region located in Upper Eastern portion, bordering Burkina Faso; capital, Bolgatanga. Image sourced from here.

Map of Ghana. Upper East region located in Upper Eastern portion, bordering Burkina Faso; capital, Bolgatanga. Image sourced from here.IRIN Africa reported a couple weeks ago about a spike in suicides amongst tomato farmers in the Upper East region of Ghana.

Women who control produce, suppliers and prices throughout the country, buy tomatoes across the border in Burkina Faso at cheaper prices, leaving local farmers to watch their crops rot in the sun, farmers told IRIN.There are other factors: Burkina Faso apparently has really great irrigation systems (financed by foreign aid) and Ghanaian tomatoes are perceived as being of inferior quality. Farmers are pressuring the government to give them some help, but it appears to be of no avail.

Now with the prospect of significant oil revenues, it looks like agriculture is only set to suffer further, potentially resulting in further farmer suicides--and regional unrest. Increased oil revenues typically lead to an appreciation of the exchange rate, which would devastate agricultural exports. In ECOWAS, at least, this could spur demand for Burkina Faso tomatoes, thereby raising those prices over time (though the effect of the EU's open-markets agreement might negate all that with product dumping--which would be a very serious problem all around). Theoretically, it looks like Ghanaian oil provides a positive externality for Burkina Faso's agriculture, and that Ghana should have an opportunity to reap a cut of those tomato revenues, perhaps to retrain farmers in the Upper East (maybe to make a complementary good, like lettuce?). Just something to think about.

No comments:

Post a Comment